New “Umbrella” for Revenue Protection Crop Insurance Plans

As we mentioned in last week’s blog, the One Big Beautiful Bill changed the rules of the game for how we analyze and execute crop insurance. This week, as we formally announce the launch of CODAK Insurance Agency, it’s fitting we analyze a new product being offered in many of our clients’ states, especially North Dakota.

Introducing CLIP: Crop Livestock Income Protection

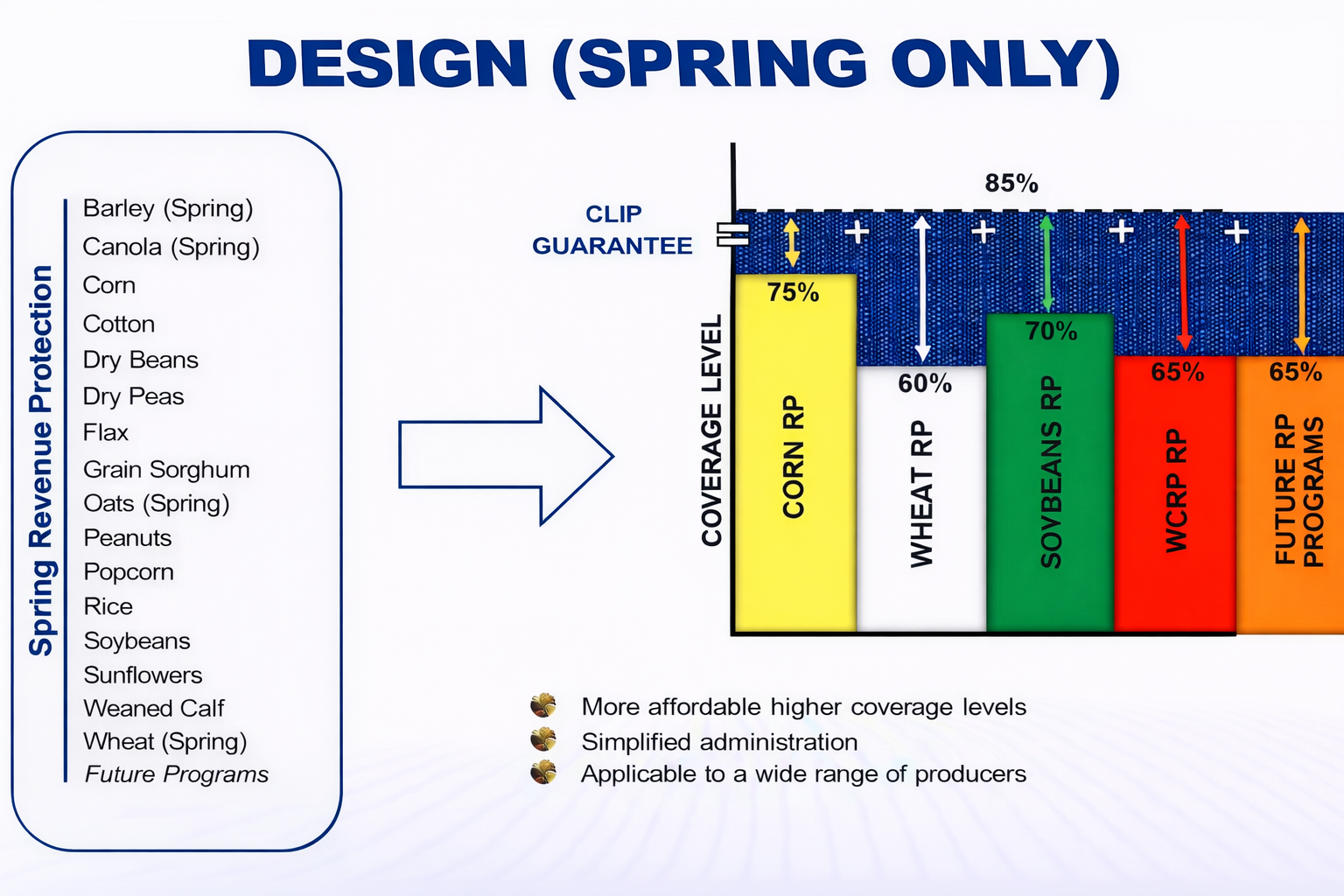

Crop Livestock Income Protection (CLIP) is a new pilot program out this year.

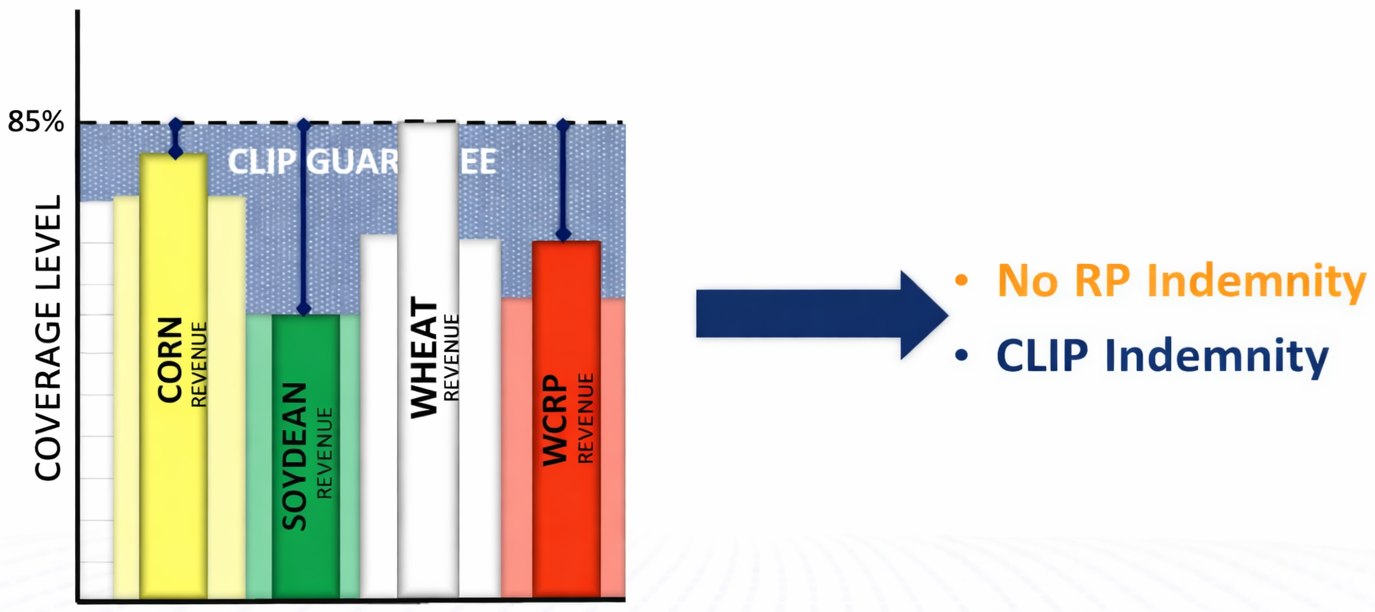

At a high level, this is an umbrella policy that sits atop underlying Revenue Protection (RP) crop insurance policies and covers the revenue “gap” between RP up to the 85% level we often don’t cover due to cost. One of our partner companies, Rain & Hail, had some good graphics to illustrate:

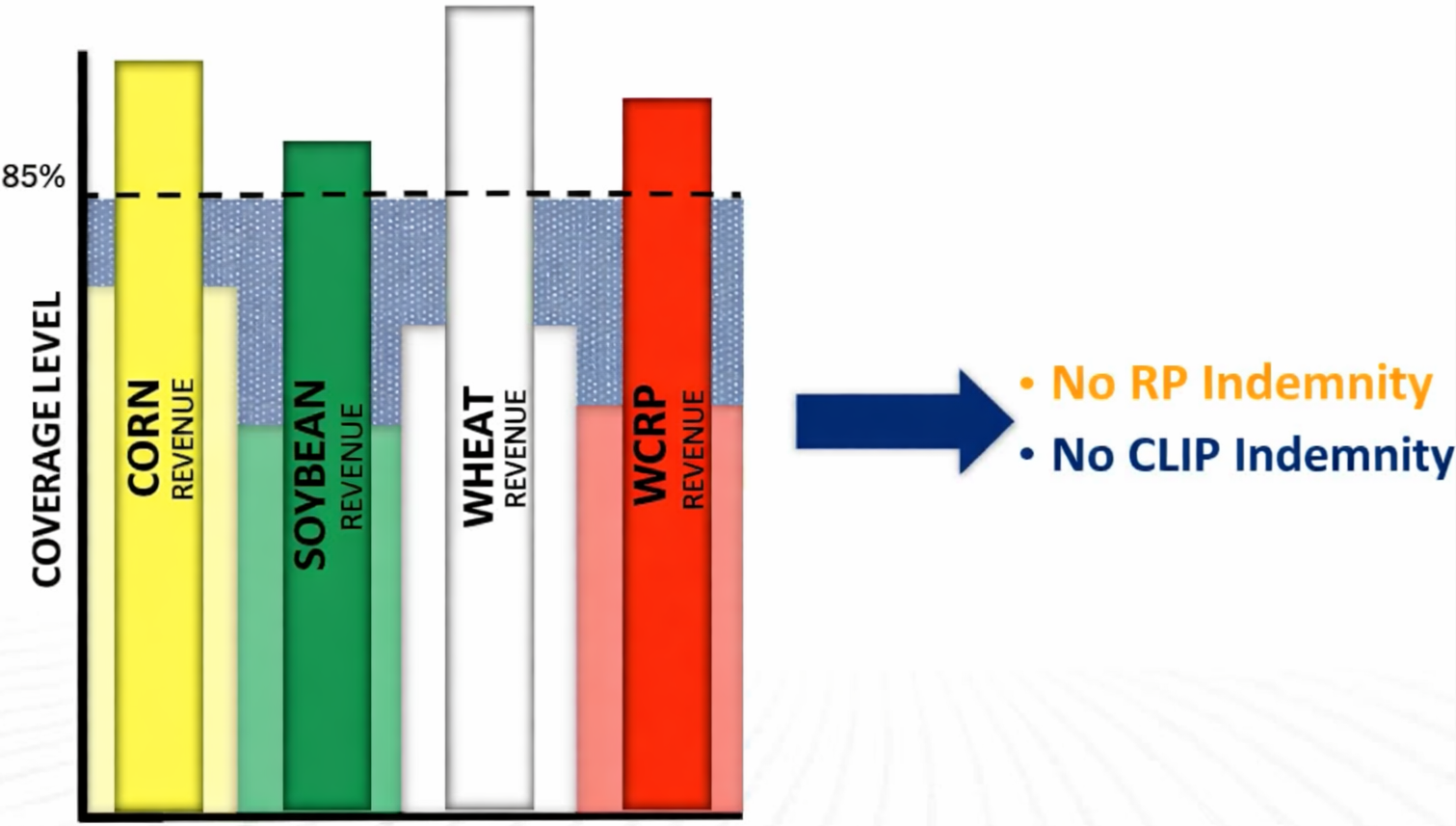

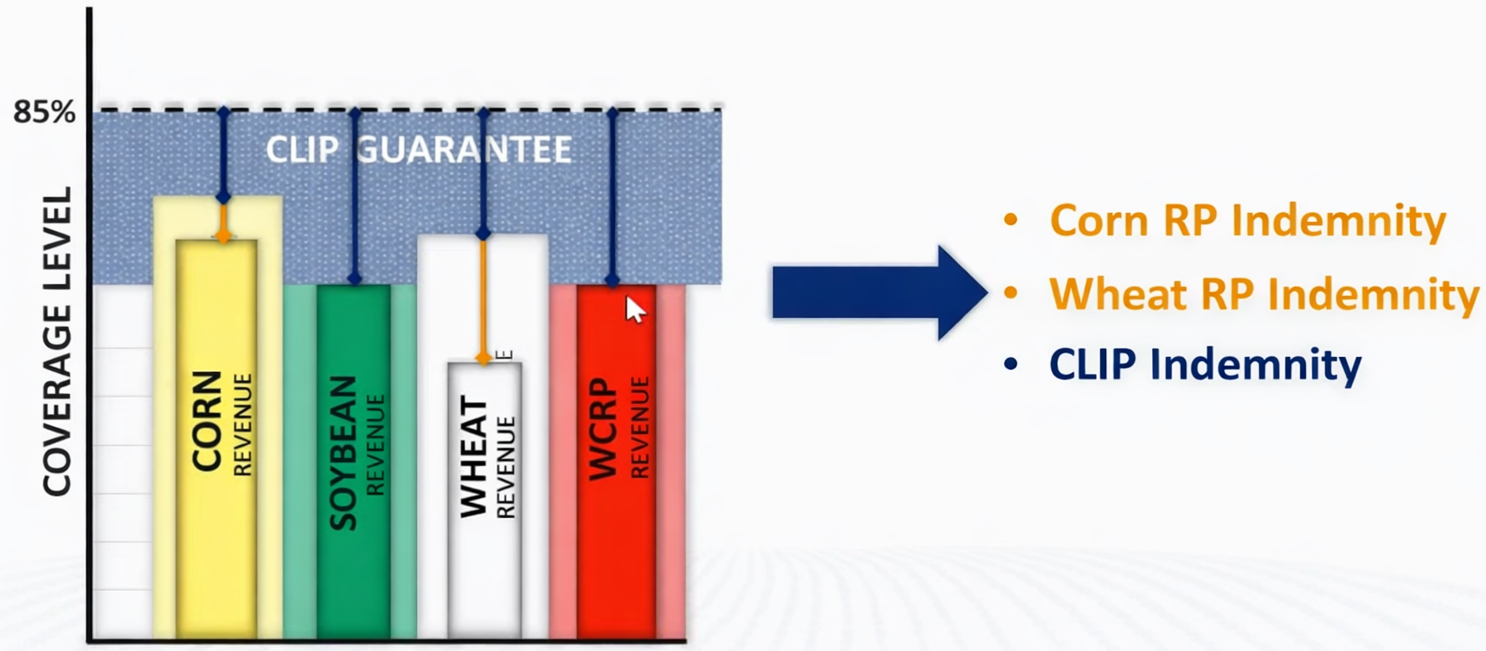

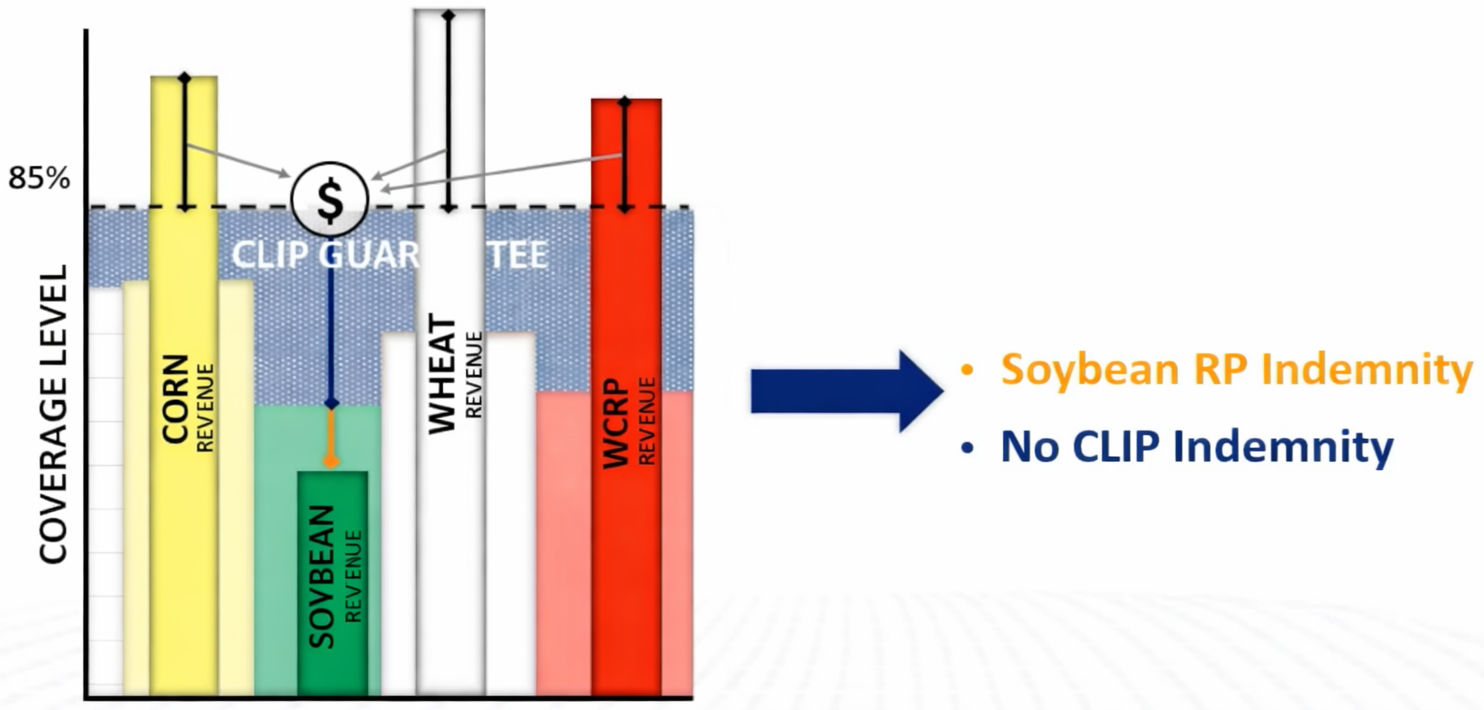

It’s expensive in most of our clients’ regions to buy up to 85%. However, insuring this gap under an umbrella structure up to 85% can reduce premiums while protecting a higher overall revenue. Think of it like Enterprise Units, but across enterprises—different commodities. There are four outcomes of a policy like this:

1. No Losses – a good year for revenue with no claims on your regular RP policies and none on CLIP.

2. Deep Losses – a universally poor year for all RP crops and also the CLIP umbrella above them.

3. Partial Underlying Loss – a good year for some crops offsets CLIP claims but doesn’t offset a poor year for one crop, causing an underlying RP claim.

4. Partial CLIP Loss – a good year for some crops but average year for others results in a CLIP payment but no underlying RP claims

So what?

We just discussed how subsidy increases made a big difference in premiums paid, especially on the county-based SCO and ECO plans. There’s merit to taking some of those savings and applying them appropriately.

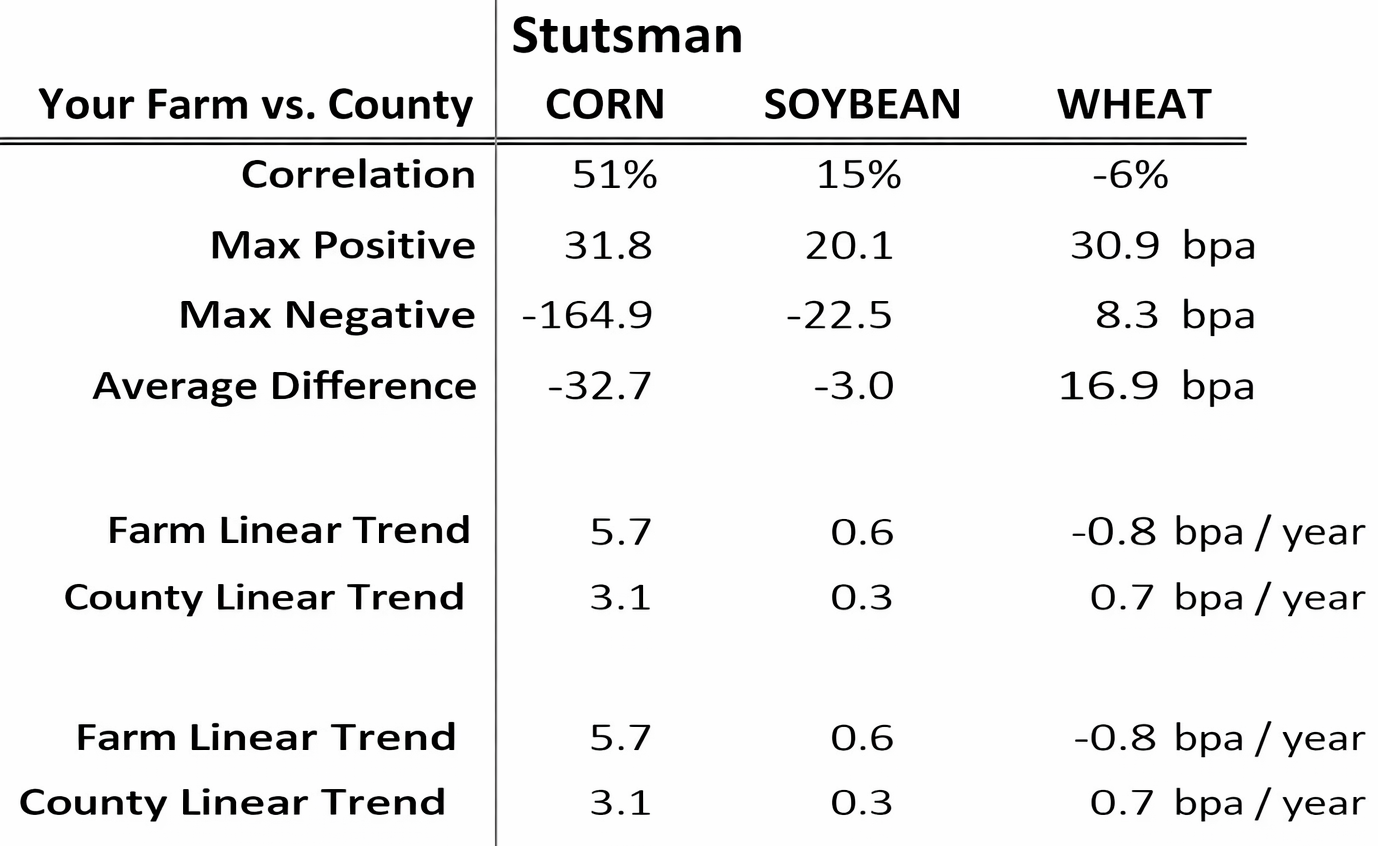

CODAK Insurance is recommending an analysis of your farm versus your county. An increased subsidy for ECO is great and absolutely an important consideration…but what if you don’t follow the county very well? We reviewed one client’s yield history** in Stutsman County for example:

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

In Stutsman County, ECO at 95% pays out 8/20 years on corn, 9/20 years on soybean and wheat. Those are pretty high payout rates, and now that ECO is roughly half the cost, that’s impressive. But look at our example above. If you are only 15% or 6% correlated with the county, is that a good buy for you? On math, sure—especially on the Soybean, where 7 of those 9 paying years were over 15% and very high. But considering individual risk management, it’s probably not a great fit. Note that poor correlation for ECO is also poor correlation for SCO as well.

Where CLIP starts to shine

Going from RP75% up to RP85%, Corn is triple the cost – From ~$15/A up to ~$46/A. Adding CLIP, however, costs roughly $10/A

CLIP can be roughly 1/3 the cost to get to 85%**

Our partners at CODAK Risk Advisory have long said: the market doesn’t care about farmer profitability, so we market to maximize revenue.

From the CODAK Insurance perspective, CLIP is a powerful tool that gets you to 85% revenue protection without dramatically increasing premium expense. The tradeoff is similar to Enterprise Units—the bushels pay the bills regardless of where they come from. But overall, you’re protecting more total farm revenue.

You’ll likely sleep better. And when it’s time to update the operating line, your banker may appreciate the added protection too.

Want to learn more?

Reach out for a free risk analysis today.

Andrew

☎︎ 309.368.3544

Disclaimer:

CODAK Risk Advisory, LLC 2026. Futures trading involves substantial risk of loss and is not suitable for every investor.

Insurance products and risk management services are subject to policy terms, eligibility, and regulatory guidelines. CODAK Insurance, LLC dba CODAK Insurance and registered as CODAK Insurance Agency, hereby mentioned as “CODAK Insurance,” is a separate legal entity from CODAK Risk Advisory, LLC, and any illustrations or examples are for discussion purposes only and not final recommendations.

Andrew Bowman

General Manager - Insurance| Market Advisor, Central Midwest

A former client turned Market Advisor, Andrew, oversees Illinois and the surrounding region. He also leads the CODAK Insurance Group, integrating crop insurance into our clients’ marketing strategies. His focus is on helping clients make confident decisions, gain peace of mind, and protect their working capital.

Connect with Andrew