Corn Shocks, Wheat Swells, and Soybeans Steady: What the USDA Report Really Says

The latest Quarterly Stock Report landed with a bang, and the market was quick to respond. While most analysts predicted a bump in supply, particularly for corn, the data painted a more nuanced picture. Let’s break down what the numbers are really telling us.

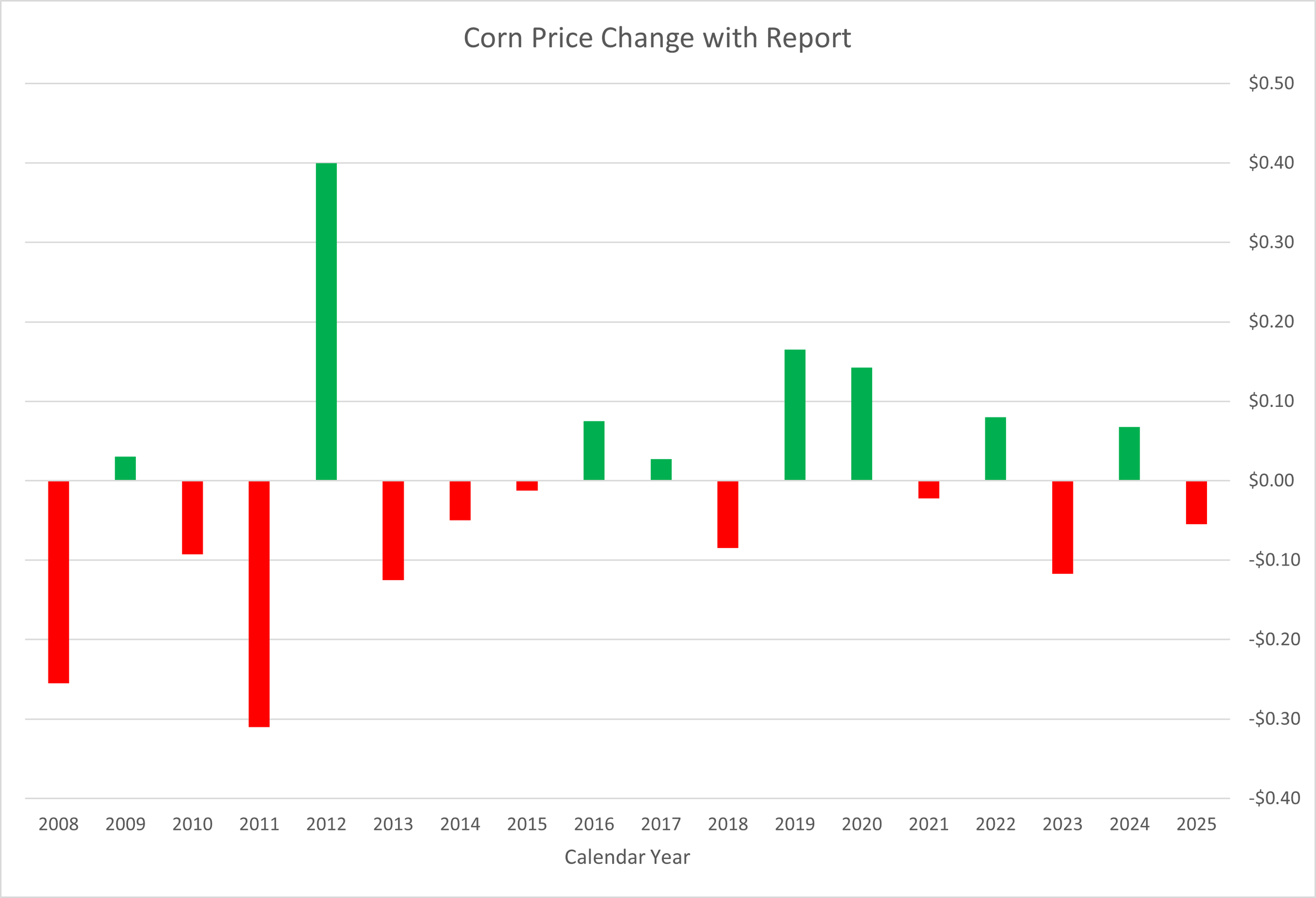

Corn Stocks Surprise the Market

Heading into the report, traders were bracing for increased corn stocks. Instead, the USDA pegged corn at 1.532 billion bushels, 195 million more than the average trade guess. Even though that's 231 million bushels lower than last year, the number still jolted the market. It revealed that expectations of higher stock levels hadn’t been fully baked into pricing models.

Meanwhile, 2024 corn acreage increased, but yield remained unchanged at 179.3 bushels per acre.

Soybeans: In Line but Leaner

Soybeans came in at 316 million bushels, about 7 million below expectations and 26 million lower than last year. This result aligned more closely with analyst expectations. Why the better accuracy? Soybeans are easier to track; exports and crush demand are more transparent than corn’s murkier feed and residual use.

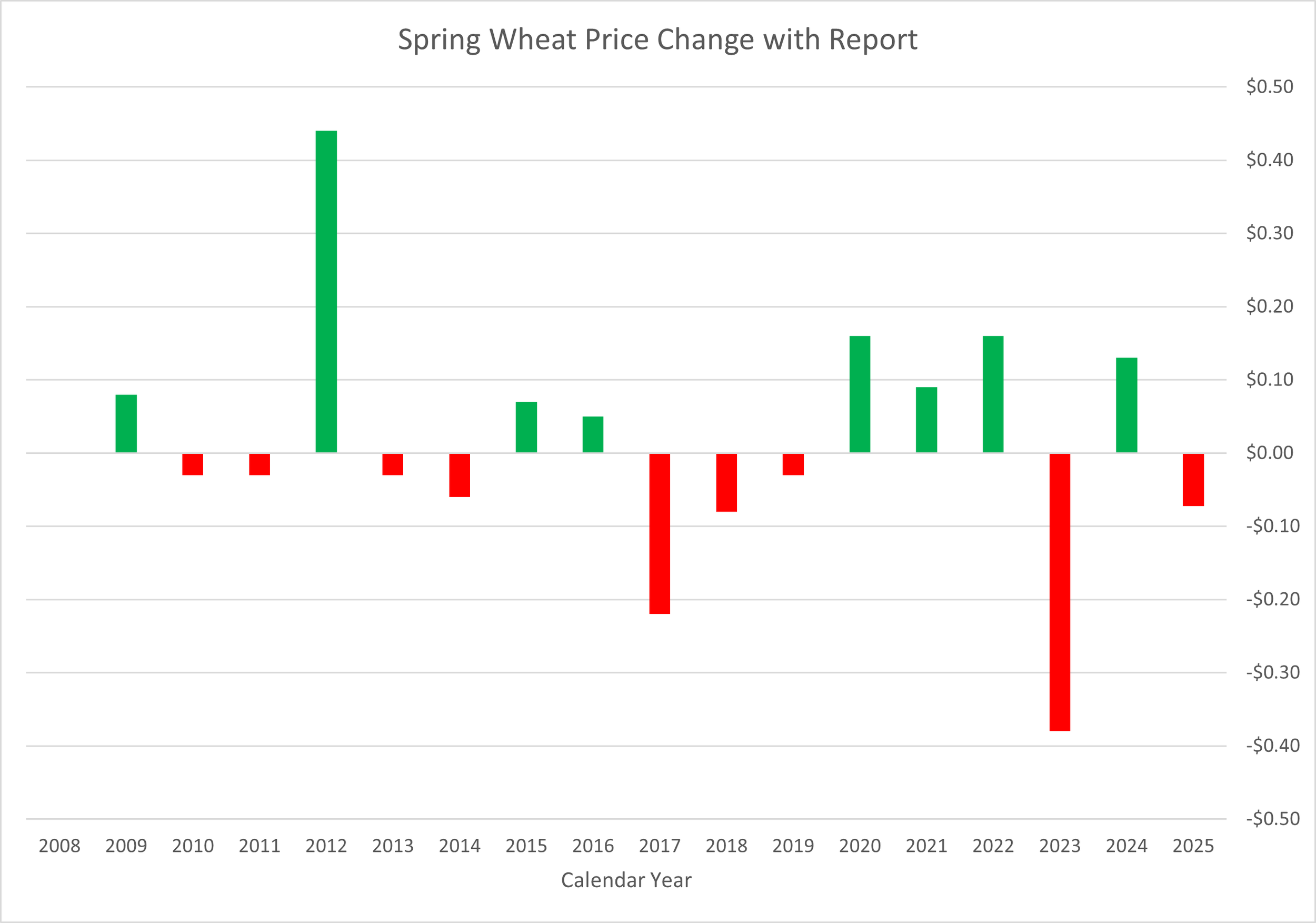

Wheat Throws a Curveball

The biggest surprise came from wheat. Stocks were reported at 2.120 billion bushels, a whopping 77 million above expectations and 128 million more than last year. The result caused volatility, as traders scrambled to reprice wheat in light of the oversupply.

Looking ahead, wheat production for 2025 is also climbing. All classes except White Wheat showed increases, all surpassing trade expectations. Combine this with rising output from export-heavy countries, and wheat prices could face continued downward pressure.

Final Thoughts

This report reminded us how fragile expectations can be, even in well-modeled markets. Corn’s surprise, wheat’s excess, and soybeans’ steady performance all tell a broader story about how quickly fundamentals can shift.

Source: USDA Grain Stocks

Ben Nuss

Market Strategist Assistant

With experience in grain buying and seed sales, Ben supports the CODAK team by aligning market strategies with farmer needs. As a market strategist assistant, he puts farmers first through practical, data-driven insights.

Connect with Ben