USDA's June Acreage Report: What to Watch

The USDA will release its much-anticipated June Acreage Report on Monday, June 30th at 11:00 AM. This pivotal report often drives volatility in the grain markets, with traders and analysts keenly watching for any surprises versus the March planting intentions.

Image from Real AG STOCK | realagstock.com

March vs. June Expectations

In March, the USDA pegged:

Corn: 95.3 million acres

Soybeans: 83.5 million acres

Wheat (all types): 45.35 million acres

That’s a combined 224.15 million acres for the main three principal crops, slightly down from 224.81 million acres in 2023.

Corn Acres: Room to Grow?

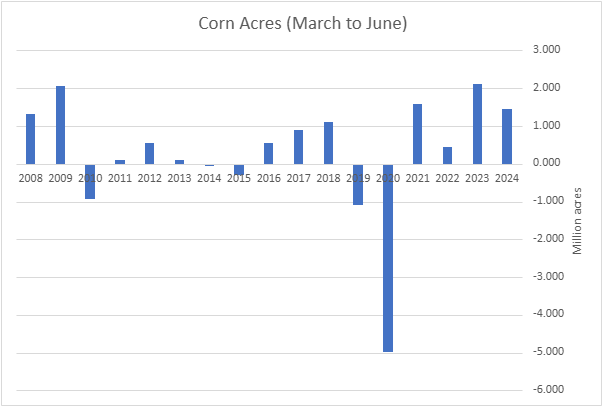

The corn market appears to be pricing in more acres than the USDA's March estimate. A confirmation of 95.3 million acres would probably be considered friendly to bullish. Historically, the USDA has tended to revise corn acres higher in June, with increases in four of the last five years averaging 1.39 million acres. The most notable miss came in 2020 due to prevent plant issues—an unlikely scenario for this year outside the Eastern Corn Belt.

Soybeans: A Cut Coming?

Soybean acreage is more prone to being overstated in the March intentions. In four of the past five years, actual June figures fell short by an average of 1.77 million acres. If this trend continues, soybean acres could slide below 82 million.

Wheat: Modest Revisions Expected

Wheat acres were estimated at 45.35 million in March. In four of the past five years the USDA has reduced wheat acreage from March to June.

Market Implications

The trade is bracing for a potential increase in corn acreage, possibly at the expense of soybean and wheat acres. Historically, the USDA often "finds" more total acres across these crops in its June report, with large prevent plant years like 2019 and 2020 being outliers.

Funds are heavily short in corn (-169,072 contracts as of June 17th), while holding long positions in soybeans (+62,289) and trimming their net short in SRW wheat (-74,256). With the large short position of funds in corn, a lower-than-expected acreage number could really ignite the market higher with help from short covering.

Corn prices have trended downward since mid-April, while soybeans and wheat have found strength. One has to wonder if farmers changed their acreage plans as corn prices fell or if they continued planting corn because conditions allowed.

Final Thoughts

All eyes are on the USDA’s June 30th release. Whether the agency confirms or deviates from its March, estimates could set the tone for summer grain markets. Watch this space for updates and market reactions after the report drops.

Source: USDA

Connor Oie

Market Advisor, Great Plains

Connor combines his commercial grain trading experience with growing up on and continued involvement in his family’s corn, soybean, and hog operation to bring our clients practical, profitable marketing solutions.

Connect with Connor